Rates (per $100 valuation)

Laval - Laurentides - Lanaudière

Taxation

Useful links

General information to taxpayers

2025 School Taxes

Interest rate

Due date

Date billing is mailed

$0.08423

8%

September 15 &

November 14, 2025

(no reminders will be sent)

July 4, 2025

Methods of Payment:

- Online: The website of your financial institution (20-digit reference number starting with 02584 on top of your tax bill). Choose SIR WILFRID LAURIER TAX (key word: Laurier).

- At most financial institutions (counter, automatic teller or automated telephone service).

- Cheque mailed to address on payment stub. (detachable portion on your bill)

- Foreign payers are to write to taxes@swlauriersb.qc.ca to obtain bank transfer information.

PLEASE NOTE THAT WE DO NOT ACCEPT ANY PAYMENTS AT THE ADMINISTRATIVE CENTRE.

NO PAYMENT BY CREDIT CARD WILL BE ACCEPTED.

Notice to taxpayers who received revised bills after April 1, 2025: Your 2025-2024 annual bill may not contain all of the amounts owing on your account. Please consult the invoices previously received.

Administrative fees

The following items are subject to an administrative fee of $20.00:

- Payments returned for Non-Sufficient Funds (NSF)

- Reversed payments by financial institutions

- Returned post-dated cheques

- Receipt or copy of an invoice / statement

- Refunds for payments made in error

School Tax Calculation

School taxes are calculated using the Standardized Assessment (municipal valuation multiplied by the standardized factor) of properties as required by section 310 of the Education Act. Municipal valuations are obtained from the municipal rolls and appear on your municipal tax bills.

In order to reduce the impact of the increase in property valuations on school taxes, school boards average increases over the same period as municipalities, that is to say 2, 3 or 4 years.

For the 2025-2026 school taxation year:

- One tax rate for all the taxable properties.

- The tax is calculated based on the value of the adjusted standardized assessment of the immovable that exceeds $25,000.

Pertinent sections of the Education Act

Section 315 & 316: School taxes are payable 31 days from the mailing of the tax bill. The current portion of school taxes in amounts equal to or greater than $300.00 is payable in two equal payments. If the first payment is not received by the due date, the entire amount becomes due immediately and incurs interest.

Section 317: No school board may waive the payment of school taxes or interest.

Change of ownership

The new owner must pay this bill before the due date even if it is addressed to the previous owner in order to avoid paying interest charges. If you are not the owner of the immovable for which this bill has been issued, please forward this bill to the new owner or return it to us.

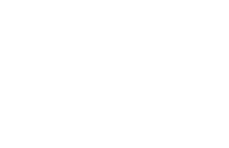

Online tax bill

The school tax bill is now available online by clicking the button “visitor”. Please note that past due balances, including interest charges, are not included in the annual school tax bill. The taxation department must be contacted to obtain the current balance due.

Contact Us

Business hours

Monday to Friday, from 9:00 a.m. to noon and 1:00 p.m. to 4:00 p.m.

Summer hours from June 30 to August 15, 2025

Monday to Thursday, from 9:00 a.m. to noon and 1:00 p.m. to 4:00 p.m.

Friday from 8:00 a.m. to noon

Offices will be closed from July 21 to August 1, 2025

A few definitions

Standardization factor

Figure provided to the municipalities by the Ministry of Municipal Affairs which determines the level of the municipal roll as a whole compared to actual value.

School tax rate

Rate allowed by the Ministère de l’Éducation et de l’Enseignement supérieur for the funding of part of the school board’s operating budget

Standardized Assessment

Municipal valuation multiplied by the standardization factor.

Find my

Find my